Welcome to Furness Building Society

For intermediaries

Choosing Furness means working together to ensure a smoother mortgage experience for you and your clients.

Working collaboratively, we’ll provide a personalised service combined with our unique approach to underwriting. Through this joint approach, we’ll help you secure mortgage solutions for even the most challenging cases.

We are currently working on fully packaged applications received on 10/12/24. View turnaround times and SLAs

Submit a DIP or application

Residential affordability calculator

Buy-to-Let affordability calculator

Let's do this together

We understand that every case is different. Our unique process prioritises a personalised experience, which is why you’ll benefit from your own business development manager from the moment you register with us. Your BDM will be on-hand to help you deliver a customised service to your clients in England, Scotland and Wales.

Let's do this together

We understand that every case is different. Our unique process prioritises a personalised experience, which is why you’ll benefit from your own business development manager from the moment you register with us. Your BDM will be on-hand to help you deliver a customised service to your clients in England, Scotland and Wales.

Our mortgage solutions

Self-build mortgages

For clients who are looking to build their own home.

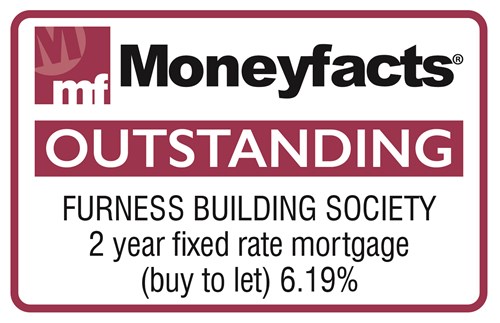

Buy-to-Let mortgages

Flexible solutions for property investors or first-time landlords.

Short-term lending

An ideal alternative to bridging loans for home movers.

First time buyers

Helping first time buyers onto the property ladder.

Self-employed mortgages

Solutions for clients with complex, self-employed incomes.

Holiday-Let mortgages

Flexible mortgage solutions for Holiday-Let investors.

Service levels

Information last updated on 23/12/24

Read our latest articles

Residential Mortgage for Company Director

Manual underwriting helped overcome barriers created by a change in company directorship.

Day in the Life of an Underwriter

Introducing Karen and Holly, whose determination to make affordability work is helping countless brokers secure mortgages.

Collaborating With Our Peers to get the Market Moving

Emma Saint explains how lenders are working together to help our brokers and their clients.

Remortgaging and product transfers made easy

Assisting clients at mortgage maturity has never been easier with our guide for intermediaries.

Making Holiday-Let possible

Business owners Scott and Helen needed help securing a Holiday-Let mortgage, due to their complex incomes.

Innovative Buy-to-Let solution

We helped Miss Peters overcome Interest Coverage Ratios (ICRs) barriers when remortgaging her rental property.

Get in touch

New business enquiries

Product transfers

Stay connected with our latest updates